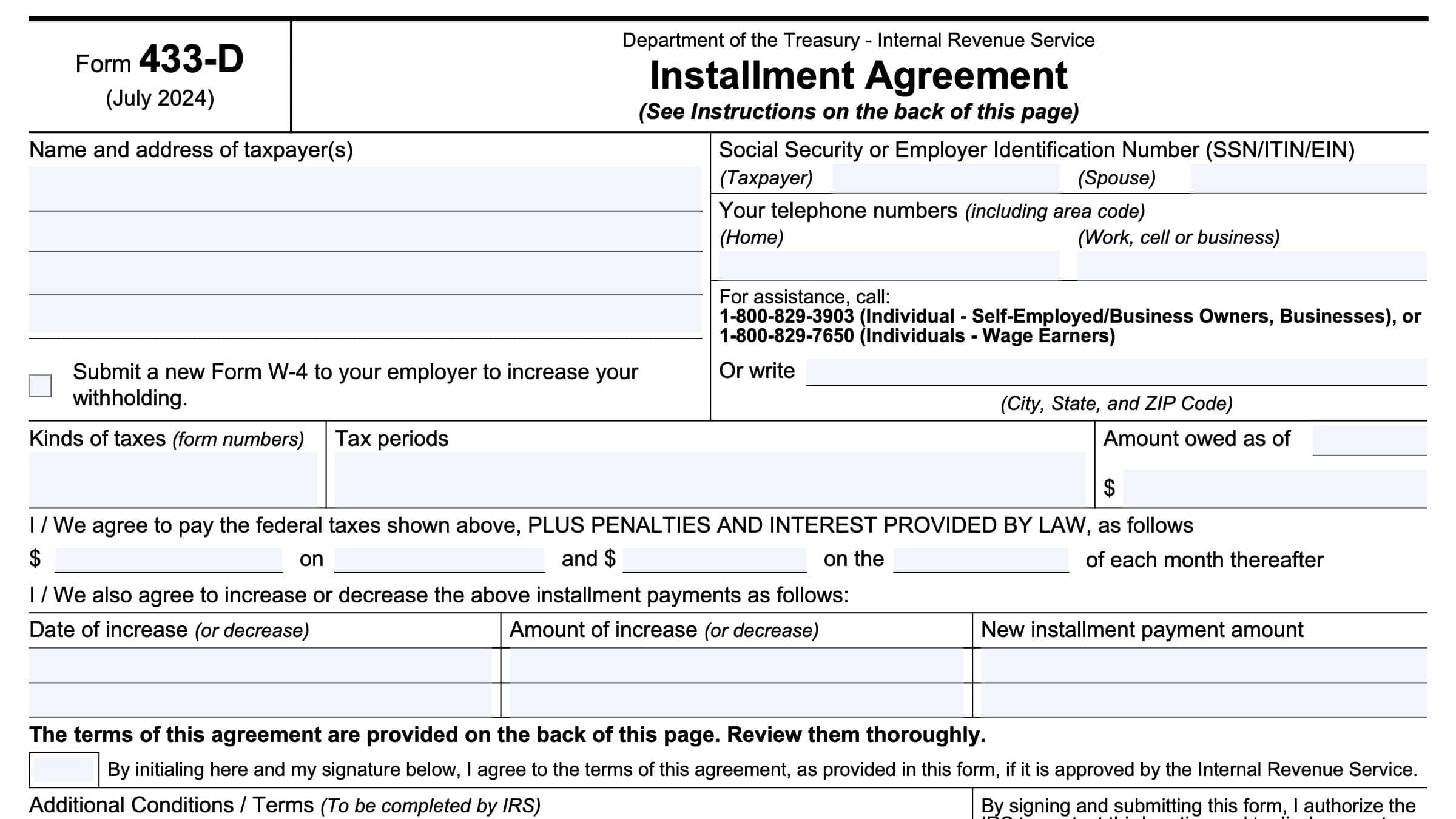

Are you in need of a free printable IRS Form 433D? Look no further! We have you covered with all the information you need to easily access and fill out this important form.

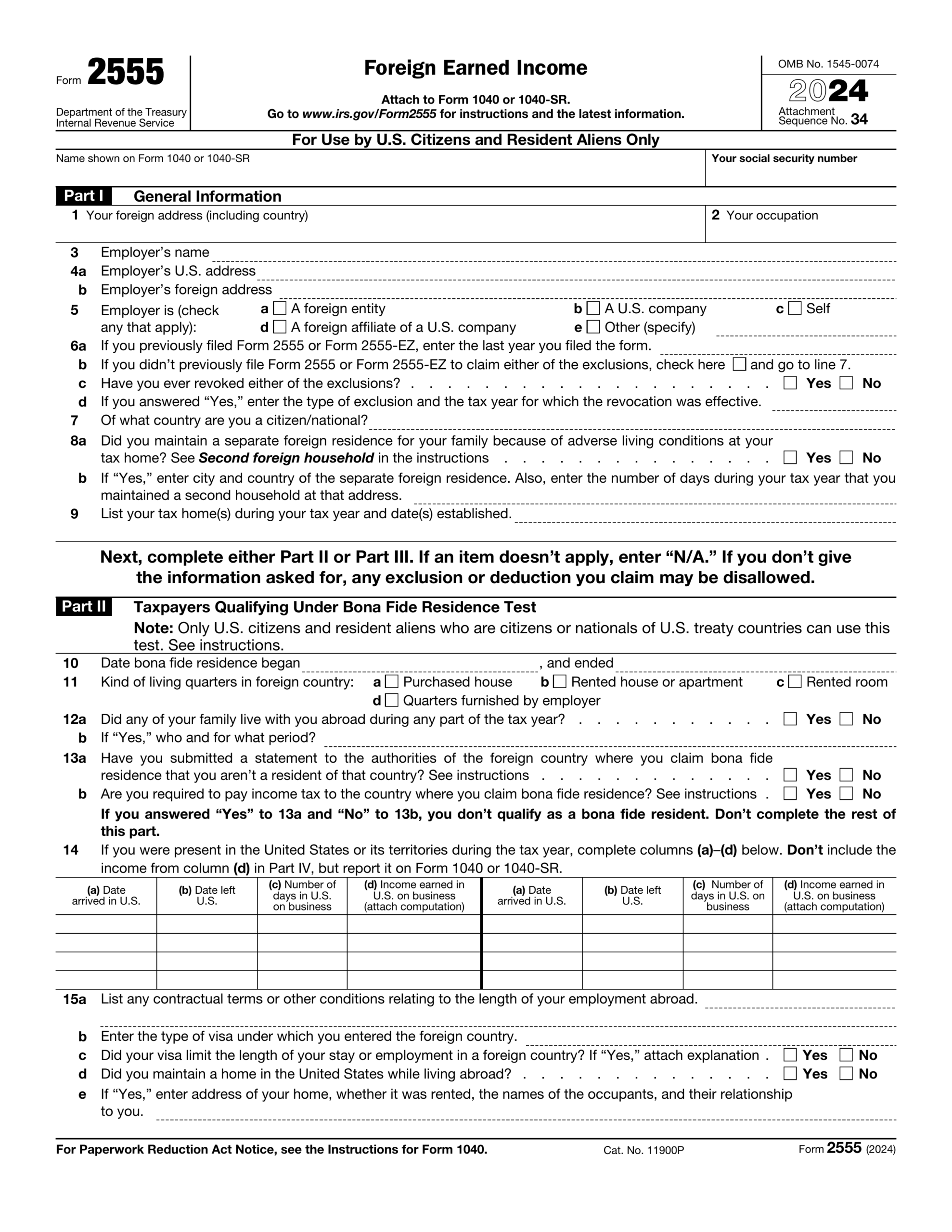

IRS Form 433D is used to provide detailed financial information to the IRS for individuals or businesses seeking a payment plan or compromise for their tax debts. It helps the IRS evaluate your ability to pay and determine the best course of action for resolving your tax debt.

Free Printable Irs Form 433d

Free Printable IRS Form 433D

Downloading and printing IRS Form 433D is quick and easy. You can find the form on the official IRS website or trusted tax preparation websites. Make sure to fill out all the required fields accurately to avoid any delays in processing your request.

When completing Form 433D, be honest and thorough in providing your financial information. This includes details about your income, expenses, assets, and liabilities. The more accurate and complete your information, the better the IRS can assess your situation and offer a suitable resolution.

Once you have filled out IRS Form 433D, submit it to the IRS along with any supporting documentation they may require. Be sure to keep copies of all documents for your records. The IRS will review your information and contact you with their decision on your payment plan or compromise.

In conclusion, IRS Form 433D is a crucial document for individuals and businesses dealing with tax debt. By following the proper steps to access, fill out, and submit this form, you can effectively communicate your financial situation to the IRS and work towards resolving your tax debt.

3 17 10 Dishonored Check File DCF And Unidentified Remittance File URF Internal Revenue Service

Form 433 D 2024 2025 Fill Edit And Download PDF Guru

Fillable Form 433 D Edit Sign U0026 Download In PDF PDFRun

Form 433 D 2024 2025 Fill Edit And Download PDF Guru

IRS Form 433 D Instructions Setting Up An Installment Agreement